Proposal: GMX Token Bridge & Stablecoin Bridge Powered by Axelar + Wormhole

Introduction

In response to the GMX community’s call for a secure and transparent expansion of GMX across multiple chains like Arbitrum, BASE, BNB, and Ethereum, the Axelar, Wormhole, Mayan and Squid teams are pleased to present a unified proposal that combines our expertise in cross-chain messaging and bridging infrastructure to support GMX’s expansion across multiple chains. Our solution addresses GMX’s requirements for unified liquidity and seamless user experience.

We’d like to express our thanks to the GMX Governance for their feedback as we’ve put together this design. Should it receive positive community feedback and DAO approval, Axelar Inc., Squid, and the Wormhole Network will jointly support GMX’s multichain expansion.

Problem Background

GMX requires a robust cross-chain infrastructure that enables:

- Unified liquidity pooling on Arbitrum while serving users across multiple chains

- Fast and cost-effective bridging for various transaction sizes

- Secure message passing for cross-chain order execution

- Support for multiple tokens and messages in single transactions

- Scalability for future chain expansions

Technical Solution

Executive Summary

We propose multiple products for the different requirements presented by GMX.

- Native Token Transfers (NTT) for bridging $GMX quickly, securely and without fragmented liquidity across chains.

- Wormhole and Axelar as cross-chain messaging solutions.

- Wormhole Bridge for cost-efficient asset transfers.

- Wormhole Settlement, Squid and Mayan as intent-based bridging protocols, for fast bridging, built on top of Axelar and Wormhole.

Native Token Transfers

Our solution implements a multi-bridge approach that combines the security and efficiency of multiple leading bridge providers, utilizing the NTT standard. This is the identical implementation that was used in the Lido wstETH proposal for BNB

We propose a multi-bridge approach that combines Wormhole and Axelar network messaging in a standardized way, and provides the GMX flexibility to add more messaging providers in the future.

- Unified Message Verification

- Implementation of a message aggregator contract that manages message verification across multiple providers

- Support for 2-of-2 or higher threshold verification

- Built-in fallback mechanisms for chain reorganizations

- Single-Transaction Single Token Bridging with Message

- Squid: Messages and tokens can be bridged simultaneously without source chain contract deployment

- Flexible Token Support

- Native support for all GMX-required assets: $GMX, USDC, stablecoins, wrapped BTCs, ETH, bitcoin LSTs, GM/GLV tokens

- Expandable token registry for future asset additions

- Optimized gas costs for multi-token transactions.

- For native-to-native USDC chain transactions, we can provide entirely gasless transactions for users - the user does not have to pay gas on the source or destination chain.

NTT - Message Architecture Overview

The main components are:

NttManager- responsible for locking and minting GMX, governance, and sending/receiving multi-bridge messages via theTransceivercomponentsTransceiver- responsible for sending and receiving cross-chain messages from a single provider .GMXon BASE, Avalanche, Solana, etc as newly deployedmintable/burnabletokens representing GMX on Arbitrum.

When a user transfers GMX from Arbitrum to a destination chain like BASE, the following steps occur:

- The user interacts with the

NttManagercontract. This contract locks the user’s GMX and sends messages to mint GMX on BASE via eachTransceivercontract. In this design, Axelar and Wormhole each implement aTransceivercontract and the GMX can choose to modify or add additional messaging providers. - Each messaging provider will perform its own verification of the message from Arbitrum and relay attestations to the corresponding

Transceivercontract on BASE. At a high level:- Wormhole’s validators (Guardians) identify messages emitted from Arbitrum, wait for finality, and produce a signed attestation once a super-majority comes to consensus. A Wormhole relayer then delivers this message to the

Wormhole Transceiveron BASE. - Axelar network is a decentralized Proof-of-Stake based network that leverages a distributed consensus to verify and route messages across chains. Once the message is posted on the source chain, the validators verify it, route it, and a relayer transmits a transaction to the destination chain approving the cross-chain message.

- Wormhole’s validators (Guardians) identify messages emitted from Arbitrum, wait for finality, and produce a signed attestation once a super-majority comes to consensus. A Wormhole relayer then delivers this message to the

Transceivercontracts on BASE Chain receive and verify their respective messages and then theNttManageraggregates these messages and verifies that the appropriate 2-of-2 threshold is met. If all checks pass, theNttManagermints GMX and delivers it to the intended recipient.

When a user transfers GMX from BASE to Arbitrum, similar steps occur with the following exceptions:

- The

NttManageron BASE will burn the user’s GMX, instead of locking. This is because BASE GMX will be a newly deployedERC20Burnable(or similar) that can be burned. - The

NttManageron Arbitrum will unlock and send GMX to the recipient, instead of minting.

This design is flexible and the GMX can choose to add more Transceiver providers or update the multi-bridge threshold, e.g. from 2-of-2 to 2-of-3 or 3-of-3.

It is also important to note that transfers between non-source chains do not require going through a “main” chain as generally happens with native bridges. Tokens are burned on one chain and minted at the destination, simplifying the user experience and reducing costs.

NTT - Transfer Costs and Times

The following table shows estimated costs of transferring tokens to Arbitrum. With NTT and the bridge, the cost is independent of the amount of tokens being transferred.

| Chain | Gas Paid | USD | Token | Note |

|---|---|---|---|---|

| ETH | 0.0003595 ETH | $0.66 | W | NTT |

| ETH | 0.0001861 ETH | $0.50 | ETHFI | NTT |

| ETH | 0.0003724 ETH | $0.97 | SWISE | NTT |

| BNB Chain | 0.0003281 BNB | $0.19 | L3 | NTT |

| BNB Chain | 0.0001813 BNB | $0.12 | L3 | NTT |

| BASE | 0.0000059 ETH | $0.01 | W | NTT |

| BASE | 0.0000008 ETH | $0.00 | L3 | NTT |

| AVAX | 0.000349 AVAX | $0.01 | WETH | Bridge. Transfer |

| AVAX | 0.0007163 AVAX | $0.01 | WETH | Bridge. Transfer with payload |

| AVAX | 0.0001674 AVAX | $0.00 | SOL | Bridge |

Times on NTT generally depend on the network block finality (unless configured otherwise by the protocol). As an example, and if we considered ‘finalized’ as desired for transfers, in average:

- Ethereum: 15 minutes

- BNB Chain: 5 seconds

- Base: 18 minutes

- Avalanche: < 1 second

Message + Bridge Architecture Overview

Wormhole supports more than 40 blockchains and Axelar supports more than 70 blockchains with the overlapping chains including Ethereum, BASE, Arbitrum, Polygon, and Avalanche. Both parties have aggressive plans to provide Day-1 support for many of the highly anticipated EVM chain launches.

- Solana has been supported by Wormhole since August 2021.

- Wormhole’s TON support is expected to begin with intents in ~1 months, with full general messaging support expected to come over the following ~6 months.

- Both Wormhole Settlement and Wormhole + Axelar multi-bridged messaging support passing payloads to the destination chain, and in the future,

- Wormhole will be able to support users who seek to bridge multiple assets at a time, as well as include a payload with them.

Intent-Based Bridging

Using suite of intents products, we are able to provide a near instant bridge for arbitrary native-to-native transfers (e.g. $ETH on Arb to $Avax on Avax) and NTT tokens (e.g. potentially $GMX or GM and GLV tokens). While built on Wormhole + Axelar multi-bridged messaging, each protocol uses a novel architecture with unique price discovery, scalability, and latency tradeoffs.

- Wormhole Settlement offers routes that can facilitate near instant intents bridging for a small premium or slower transfers at nearly zero cost.

- For native-to-native USDC chain transactions, we are able to provide entirely gasless transactions for users - the user does not have to pay gas on the source nor destination chain.

- Working with GMX, we can whitelist other assets for this service (e.g. $GMX, $GM, etc..).

- Chain reorgs risks are placed on solvers and do not impact the user, if they occur.

Settlement - Price and Cost

Wormhole Settlement provides a series of estimates for some chains and assets requested by GMX.

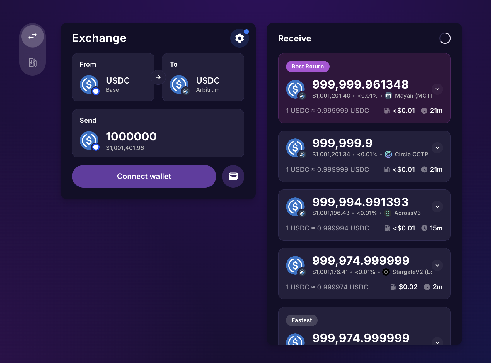

- Base to ARB: $1m USDC cost of <$0.04 and 21 minutes via Mayan MCTP (a Wormhole Settlement protocol - see Jumper screenshot below). For faster transfers, integrators can leverage Mayan Swift, where execution times occur in seconds.

- Base to ARB: $1,000 USDC → ~$998.84 at <7 seconds

- Base to ARB: $10,000 USDC → ~$9,996.55 at <7 seconds

Mayan Bridge

- Mayan is a cross-chain swap auction protocol designed to deliver optimal swap rates and rapid asset transfers using three complementary methods – WH Swap, MCTP, and Swift.

- MCTP leverages Circle’s CCTP to convert input tokens to USDC and dispatch messages directly to smart contracts on destination chains, ensuring secure and efficient value delivery.

- Swift method allows users to lock funds on the source chain and trigger an auction on Solana, where a designated driver fulfills the order on the destination chain in near-instant speeds.

- Mayan major chains such as Ethereum, Arbitrum, BASE, BNB, Polygon, and Avalanche, Mayan facilitates cross-chain swaps for over 1,000 assets. It offers seamless integration while maintaining low fees and deep liquidity.

Squid Router

- Squid’s Multicall is designed specifically for payload generation on the client, so a developer can use javascript only to build withdrawal and deposit transactions before and after a bridge or swap.

- The Squid Multicall allows for transaction bundling, such as approve → deposit → transfer receipt, reducing load on the destination chain smart contract. On the source chain, a user can exchange their receipt token for e.g. USDC in a pre-hook, then swap it across chains and deposit in a post hook, all in one transaction.

- Squid’s pre and post hooks allow developers to build arbitrarily long transaction bundles before and after the bridge and swap using e.g. typescript. This reduces load on smart contract development, improving security.

Squid – Performance Metrics

- TL;DR

- Price: Squid’s RFQ (Intent Centric) called Coral charge only 1 bp for any amount of major stablecoins like USDC & USDT which is cheaper than the industrial level

- As of now, Squid CORAL can support up to $100K deal and will continue to increase per bridge size.

- Speed (Medium calculated by hundred of thousands of txs):

- Bridging across L2s takes 5 seconds (saving 50%~70% of the processing time compared to other players)

- Bridging from/to Ethereum takes 25 seconds

- Price: Squid’s RFQ (Intent Centric) called Coral charge only 1 bp for any amount of major stablecoins like USDC & USDT which is cheaper than the industrial level

- Cross-Chain Swap:

- Squid has integrated major DEXs (110 liquidity sources) across chains, which allows users/protocols have more choices to migrate liquidity to desire tokens on chains you have been providing services to. What’s more, Squid’s CORAL also supports cross-chain swap for major tokens including USDC, USDT, BTC, ETH, etc, with the fixed rates without swapping through DEXs, which means there is no slippage. Notably, Squid is willing to support bitcoin LSTs, GMX’s own GM & GLV tokens if the proposal is approved by the GMX DAO.

- Cheapest: Squid has a unique structure to provide cross-chain bridging via AMM model and RFQ (Intent Centric) called Coral, which makes the price most competitive in the market.

- Fastest: Squid has RFQ (Intent Centric) called Coral, which makes the processing time taking 5 secs only on average. Citing the attached picture, Coral completes each bridge transaction within 3-10 secs, which is much faster than players like Stargate (40secs~5mins) & Across (10-15 secs)

Coral Real-Time Transactions

Squid – Estimated Bridging Times and Costs (Bridge Stablecoins Across Arbitrum and BASE)

| Amount | Time (median) | Cost (USD) |

|---|---|---|

| $1K | 5 seconds | $0.1 |

| $10K | 5 seconds | $1 |

| $100K | 5 seconds | $10 |

General Security and Operational Considerations

Security is paramount, and this proposal joins the security measures of Wormhole and Axelar network together to protect GMX users. Axelar network implements multi-layered security starting with the decentralized protocol, followed by robust engineering, and application-level addons. The Wormhole network incorporates defence-in-depth measures like the Global Accountant and Governor, has gone through extensive audits and maintains multimillion-dollar public bug bounties to maintain high security and operational standards.

The Wormhole Protocol’s security program has been managed by Asymmetric Research since 2023. The team brings extensive security expertise through its leadership - Felix Wilhelm, formerly of Google Project Zero, and Jonathan Claudius, previously head of security at Mozilla and Jump Crypto. Leveraging their deep experience in blockchain security, Asymmetric Research oversees all aspects of Wormhole’s security operations, including incident response and vulnerability management.

Both protocols have undergone extensive audits and maintain large public bug bounties to maintain high security and operational standards.

For near instant bridging, Wormhole Settlement solvers (RockawayX, Flow Traders, Tokka Labs, and others) handle all source chain reorg risk.

Wormhole protocol messages use stable IDs (digests) that are resilient against chain reorgs. Each message includes destination chain, destination wallet address, output token address, minimum output amount, gas drop amount, deadline, and 32 bytes of random hex to prevent collisions - a keccak-256 hash is then calculated to identify the order. Wormhole does not include any timestamp, block number, or other inputs into the orderID that may be impacted by a reorg to ensure stable orderID construction.

Axelar is designed with a security first approach. The Axelar network is itself a proof-of-stake blockchain, secured by a set of 75 validators. This validator set is permissionless, meaning that anyone can join and participate in the security of the network. When sending a cross-chain transaction that message is sent from the source chain to the destination via the Axelar network. While the message is routed through the Axelar network, the Axelar validator set must come to consensus on the message that was sent. The authenticity of the message from the source chain is therefore confirmed by the decentralized validator set. To ensure the network decentralization Axelar also employs quadratic voting, this sets the number of votes each validator gets to a square root of their stake. The major benefit being that it restricts the ability of the top few validators to have too much influence over the network when it comes to governance proposals. Validators are also required to periodically rotate their keys amongst other best practices to protect the network from attackers trying to accumulate keys maliciously.

As an added layer of security, Axelar has fallback solutions to protect the network from any incidents. Axelar employs rate limits for high priority routing assets such as USDX or ETH. Axelar services such as its Interchain Token Service also allow token integrators to set rate limits at the contract layer for their assets.

On the Axelar side, to address the possibility of a reorg the protocol has a unique Command Id. Generating a command id involves combining specific attributes of the message, such as the source chain, message id (transaction hash + event index), and other relevant data, and then hashing this combination to produce a unique identifier. This process ensures that each command id is unique for the message it represents.

While a multi-bridge approach is subject to the combined uptime of all providers, Wormhole and the Axelar network are both designed with resilience in mind and have encountered no significant downtime in the past year.

Axelar Network:

-

Audits: GitHub - axelarnetwork/audits: Axelar network audits

-

Bug bounty: Axelar Network Bug Bounties | Immunefi

-

Security overview: https://axelar.network/blog/security-at-axelar-core

Squid:

-

Security overview: Squid’s 9 Audits, primary reliance on Axelar, and stateless contracts provide very good security. Squid has never had a security incident.

Wormhole:

-

Audits: wormhole/SECURITY.md at main · wormhole-foundation/wormhole · GitHub

-

Bug bounty: Wormhole Bug Bounties | Immunefi

-

Security overview: Cross-chain security | Wormhole

Conclusion

Our joint proposal offers GMX a comprehensive solution that meets all technical requirements. We are committed to fostering GMX’s growth across multiple chains while maintaining the highest standards of security and performance.

About Axelar

Axelar network is the leading interoperability layer for Web3. The network enables blockchain as a new kind of development platform, integrating diverse networks into a seamless “Internet of blockchains.” Axelar is programmable and decentralized, secured by a proof-of-stake token, AXL. Application users access any digital asset or application, with one click. Developers work with a simple API and access an ecosystem of tools and service providers.

Axelar is funded by top-tier investors, including Binance, Coinbase, Dragonfly Capital, Galaxy and Polychain Capital. Major partnerships and integrations include Microsoft, Mastercard, JPM, dYdX and Uniswap. Axelar’s team includes experts in distributed systems/cryptography and MIT/Google/Consensys alumni; the co-founders, Sergey Gorbunov and Georgios Vlachos, were founding team members at Algorand.

About Squid

Squid creates unlimited access for anything in crypto. Squid can be used to seamlessly swap and bridge across 80+ chains all from one place, and Squid NFT Checkout can be used to buy any NFT using any token. Squid’s API, SDK, and Widgets offer ease of integration for projects building on any chain to enable cross-chain functionality in just 1 click.

About Wormhole

Wormhole is the longest-running generic cross-chain messaging protocol, with the first production message sent in August 2021. Hundreds of projects have leveraged Wormhole to transfer over 57 billion USD of value and over 1 billion messages across more than 40 chains. These messages enable sending price oracle data, transferring tokens between chains, building cross-chain DeFi protocols, cross-chain governance, and many other use cases.

Wormhole supports over 40 blockchains, including Ethereum, Solana, Arbitrum, Polygon. It supports Avalanche, leading stablecoins like USDC.e (Fantom) using Native Token Transfers or USDC using CCTP. There is also the possibility of using wrapped assets via Bridge.

Additionally, Wormhole was named the only unconditionally approved protocol by the Uniswap Foundation’s Bridge Assessment Committee - Bridge Assessment Report.