Overview

Hi all, we’re Chaos Labs, a leading cloud-based risk management platform specializing in optimization and economic security tools for DeFi protocols. We collaborate with protocols such as Aave, Osmosis, Benqi, Uniswap, Chainlink, and more, to provide robust risk management products and services.

Over the past few months, we have been working with GMX core contributors, users, integrated protocols, and DAO members to develop an advanced platform dedicated to addressing margin at risk, real-time user metrics, alerting, and simulations that evaluate the value at risk (VaR) across volatile markets. Today, we are proud to unveil Version 0 of the GMX GLP Public Risk Hub.

Below, we will detail platform features. This is V0 of the product, and we’d love any feedback, and/or feature requests from the community to integrate into future iterations ![]()

Goals

The primary aim of the GMX GLP Risk Hub is to facilitate informed decision-making for users and DAO members regarding their personal and protocol-wide positions. By offering insights into the size and balance of long and short open interest in each market, this application ensures users can navigate turbulent markets with confidence. We present an overview of the application’s functionality by examining each tab in detail.

Methodology

The GMX platform is currently deployed across two distinct blockchains: Arbitrum and Avalanche. In an effort to provide a scalable, future-proof solution, we have developed an additional data layer atop GMX subgraphs. Our infrastructure persistently queries archive nodes and subgraphs, consolidating the information into a singular database and generating aggregated data collections. These collections are indexed to enable rapid querying, reduced latency, and an efficient user experience.

Platform Deep Dive

Overview

This page presents information on a per-deployment basis. The network selector at the top of the interface allows users to alternate between data and metrics for the Arbitrum and Avalanche deployments. The metrics available on this page comprise key indicators such as the total GLP pool size, 24-hour fees and volume, and total open interest. Furthermore, the page furnishes users access to time series data that displays the GLP pool value, composition, short and long open interest, and daily fees in graphical format.

GMX GLP Overview Page to view high-level protocol metrics and analytics.

Markets

The markets page showcases all assets supported for opening a long or a short position. In its primary view, the page provides users with market metadata, including data on short and long open interest, short and long leverage, and short and long positions.

GMX GLP Markets Page

Market Detail

Upon selecting a specific market, users will be directed to a more detailed view of the market, where they can access in-depth analytics. The Market Detail page presents information on short and long open interest, open interest imbalance, long and short position counters, and average leverage for each side. In addition, the page provides access to time series data for asset price and open interest distribution. Moreover, the page features a market-specific positions table that allows users to view all positions within a given market.

View analytics and insights pertaining to specific markets.

Positions

The positions page presents a comprehensive table that showcases all positions within the GMX protocol, both open and settled. Users can conveniently search for specific wallet addresses or leverage the advanced filtering functionality that enables filtering positions by assets, profit and loss, leverage, and type (long or short).

View all GMX positions.

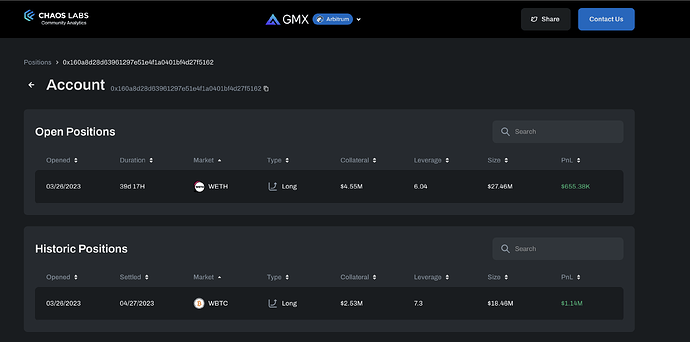

Account Detail

By selecting a specific row in the positions page, users will be directed to the account detail page, which displays all active and closed positions in GLP for that account, thereby enabling a comprehensive analysis of a trader’s status and history.

View details pertaining to a specific position.

Liquidations

The liquidations page presents aggregated metadata on protocol liquidations spanning 7, 30, and 90-day time frames. Moreover, the page offers a graphical representation of observed liquidation events on a daily basis, as well as a table that displays relevant liquidation events. Users can select a specific liquidation event, which will direct them to the Position Detail page of the corresponding account for a more detailed analysis.

View all GMX Liquidations.

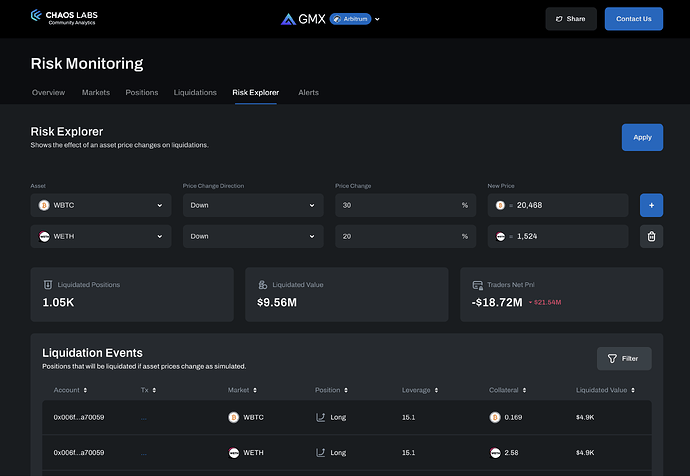

Risk Explorer

The risk explorer feature empowers users to conduct simulations on one or multiple assets, simulating price drops and gauging the impact on their positions. This functionality is particularly useful in comprehending the risk exposure of a position in light of market volatility. We will provide further information on this feature, including more simulation details.

Use the risk explorer to understand how market movements affect position health..

Alerts

The alerts tab offers real-time notifications on GMX protocol activity. The alerts tab offers real-time notifications on GMX protocol activity. Each alert features a link to the corresponding account detail page. Furthermore, users can click on the Join Telegram Channel to receive updates directly in Telegram. In the next iteration of the alerts page, we plan to introduce a webhook feature enabling users to integrate Chaos alerts into additional applications such as Slack and Discord.

Use the alert tab to view alerts and indicators for how protocol risk is changing in real-time..

Next steps

Our platform is constantly evolving and growing to meet our users’ needs. We invite the GMX community to explore the platform and provide your feedback. You can access the platform here.

If you have any questions or comments, feel free to contact us on Twitter or email us at gmx@chaoslabs.xyz.

About Chaos Labs

Chaos Labs is a leading cloud-based platform specializing in developing risk management and economic security tools for decentralized finance (DeFi) protocols. The platform leverages sophisticated and scalable simulations to stress test protocols in adverse and turbulent market conditions. As a trusted partner to many DeFi protocols, Chaos Labs is committed to creating innovative solutions that enhance the efficiency and security of DeFi marketplaces.