Background

In the current GM/GLV structure, LPs earn trading fees and borrowing fees but also bear directional PnL risk from traders. This behaves similar to impermanent loss:

- When traders are profitable overall, LP returns decrease or even turn negative.

- When traders lose overall, LP returns increase.

The great success of the Single-Sided BTC Pool ($66m), Single-Sided ETH Pool ($50m) confirms the existence of LP segments with different risk appetites. By separating GM/GLV fees income from PnL risk, we can better match different LP preferences, attract more liquidity, and significantly improve competitiveness - especially as we are about to expand to ETH mainnet.

Objective

Introduce the Global Hedge Vault (GHV) as a separate, investable hedge vault to absorb PnL volatility from GM/GLV:

- Provide GM/GLV LPs with risk-neutral returns by removing PnL exposure.

- Allow higher risk preference LPs to earn PnL-driven returns via GHV.

- Enable structured risk products without altering any GM/GLV architecture.

Mechanism

- The GHV account is protocol-whitelisted, trading with 0 fees to minimize hedge costs.

- Each time a trader opens a position, GHV opens an equal-sized opposite position to maintain OI balance (eg. BTC Long = $50m, BTC Short = $48m → OI Balance = $2m (long bias) GHV opens $2m short → BTC Long = $50m, BTC Short = ($48m + $2m)).

Impact

- GM/GLV LPs’ directional risk is entirely shifted to GHV. GHV LPs bear the PnL volatility in exchange for a risk premium.

- As for market arbitrage interaction:

a. If professional arbitrageurs exist, they only need to understand GHV’s mechanism and identify GHV’s position, then they can still open a $2m short for arbitrage, with the short increasing from $50m to $52m and then quickly returning to $50m.

b. If arbitrageurs are absent, GHV holds the exposure and absorbs related PnL.

Return & Risk Allocation

- GM/GLV LPs: Earn risk-neutral returns (trading fees + borrowing fees) with no need to self-hedge.

- GHV LPs: Earn PnL-driven returns, historically positive and stable. GHV significantly lowers risk for GM/GLV LPs, attracts stronger liquidity, creates a new product class for risk-seeking investors, and provides a sustainable risk-transfer and yield-splitting mechanism to support multi-chain growth.

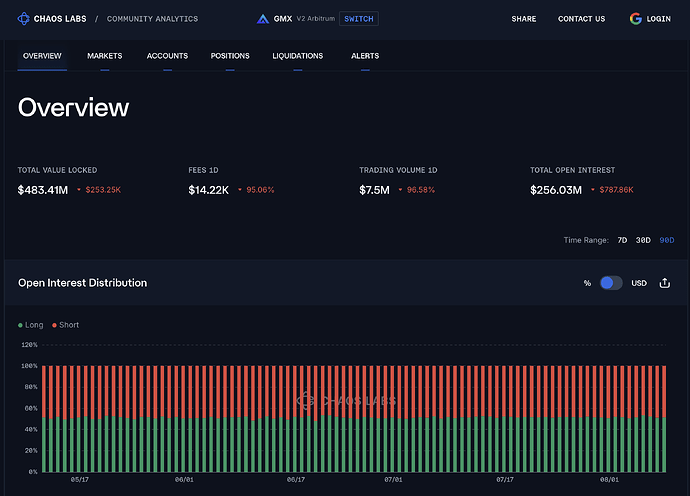

- In GMX V2, the largest cumulative trader loss was $16m, while the largest cumulative trader profit was $7m. Since the deployment of the adaptive funding fee mechanism, OI balance has been well maintained, resulting in a more stable PnL curve.

Structured Product Potential

With GHV, GM/GLV can be decomposed into (referencing Pendle’s terminology for easier understanding):

- PT-GM/GLV: It is only exposed to backed assets and automatically accrues fees from leverage trading and swaps for the corresponding market.

- YT-GM/GLV: Holds only PnL risk exposure, potentially positive or negative.

In this case, PT-GM/GLV is the current GM/GLV token, and YT-GM/GLV is the GHV token.

PT-GM:BTC-BTC APY 4.86% / YT-GM:BTC-BTC APY 3.84%

PT-GM:ETH-ETH APY 7.39% / YT-GM:ETH-ETH APY 5.08%

Implementation Cost & Compatibility

- GHV acts like an external trader/MM and does not require GM/GLV core changes which means almost zero implementation cost.

- Full compatibility of working with existing architecture; deployable to ETH mainnet or other new chain seamlessly.

Risk Assessment

- In extreme cases, GHV’s NAV could go to zero, but GM/GLV would continue operating as before.

- It carries concentration risk. Large single-market exposure in GHV needs diversification controls.

Extension Possibility

With LP risk significantly reduced, a small adjustment in fee allocation could strengthen GHV: eg. Reduce LP fee share from 63% → 50%, redirect 13% to the GMX Treasury for GHV replenishment.

All discussion are welcomed.

Q