SECTION 1: APPLICANT INFORMATION

Applicant Name or Alias: frondoto

Project Name: Beefy

Project Description: Beefy automates yield farming to make DeFi easy, safe and efficient for all. By autocompounding your tokens, Beefy unlocks higher returns so you earn more of what you love.

Team Members and Qualifications:

Weso - Solidity Developer

Roman Monk - Solidity Developer

Kexley - Solidity Developer

EPETE - Operations

Jack Gale - Finance

Frondoto - Business Development

Chebin - Backend Developer

Chimp - Backend/Frontend Developer

Eren - Frontend Developer

DefiDebauchery - Infrastructure

MrTitoune - Infrastructure

YR - Design

TBC - Marketing & Social Media

Project Links:

https://twitter.com/beefyfinance

Contact Information

TG: @frondoto

Twitter: @frondoto1

Email: frondoto@beefy. com

SECTION 2: GRANT INFORMATION

Requested Grant Size: 150,000 ARB

Grant Matching: No grant matching

Grant Breakdown: [Please provide a high-level overview and pro forma of the budget breakdown and planned use of funds]

Funding Address: Beefy’s Arbitrum Safe

Funding Address Characteristics:

Beefy’s multi-sig Treasury is controlled by the Treasury Council which has 8 members, and requires consensus from any 4 to sign off on any multisig transaction before it can be executed.

Details of the current 8 members and their Treasury EOA wallets are:

frondoto

ChiliConCarne

DefiDebauchery

Moodini

EPETE

JackGale

TBC

YR2150

Distribution Contract Address:

0x2951C806A75B19954Ce0BEd477676A54f3c1C200 for Boost Factory smart contract that will be used to create the incentivization contracts for different vaults.

Incentivised Contract Addresses:

BTC-USDC vault: 0xBE62C3b16789901066F882D94EF356f9C6aac414

ETH-USDC vault: 0xfb1Ea0ec3F727Cb62E0c8884d0Ae9aBAb32986ED

ARB-USDC vault: 0x56849a2632B29593fEF937aEAF397abE1368d2C9

LINK-USDC vault: 0xf3C483077c0202c2bc004E139B2e78e6e0f72593

SOL-USDC vault: 0xf3C483077c0202c2bc004E139B2e78e6e0f72593

SECTION 3: GRANT OBJECTIVES AND EXECUTION

Objectives: Beefy’s app is multichain, meaning that users connecting from any chain will see the boosted vaults at the top of the app. The objective of this grant is to attract new users to GMX, and to its many ways to participate (providing liquidity/earning, trading, etc). Users staking in the boosts will earn the vault compounded interest, plus extra ARB. Beefy’s marketing team will draft comprehensive content to showcase GMX to our audience through blogs, tweets, discord announcements, and more.

Key Performance Indicators (KPIs):

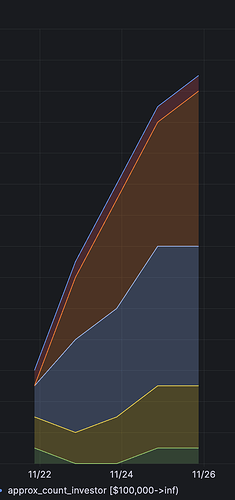

We will measure the amount of unique users in the GMX vaults (expecting 1,500 unique new users), and Total Value Locked (around $16M).

How will receiving a grant enable you to foster growth or innovation within the GMX ecosystem?:

The goal is to introduce Beefy’s audience to the GMX protocol through different types of communications, and with the boosted vaults as the center of the initiative.

Justification for the size of the grant:

We calculated that 150,000 ARB distributed during 7 weeks (approximately until end of GMX STIP distribution period) in 5 vaults (BTC-USDC, ETH-USDC, ARB-USDC, LINK-USDC, SOL-USDC), would yield between 6% and 13% extra APR.

**Execution Strategy:

Grant Timeline:

We will start the distribution of ARB a few days after receiving the tokens (need 2 to 3 days to deploy the contracts) and until 31 Jan. The weight of the allocation will be:

BTC-USDC: 0.35

ETH-USDC: 0.35

ARB-USDC: 0.2

LINK-USDC: 0.05

SOL-USDC: 0.05

Fund Streaming: Ideally we would need to fund the boost contracts in one go (or as few as possible, to avoid rewards stopping and manual actions.)

SECTION 4: PROTOCOL DETAILS

What date did you build on GMX?: Feb-09-2023 was the first GLP vault deployed on Beefy

Protocol Performance:

Beefy’s GLP Arbitrum vault had an ATH of $7,000,000 TVL in April 2023.

Protocol Roadmap:

Beefy just deployed new vaults supporting the new GM liquidity.

Audit History (if any): GitHub - beefyfinance/beefy-audits

SECTION 5: Data and Reporting

Is your team prepared to create Dune Spells and/or Dashboards for your incentive program?:

Yes, we will periodically report the amount of unique users in the vaults, TVL, and sizes of deposits, through our analytics dashboard.

Does your team agree to provide bi-weekly program updates on the GMX Forum thread?: Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?:

Yes